Creating value and strategy for connecting growth.

Providing high quality services and effective solutions based on expert knowledge of the business sector, first-hand managerial experience, deep understanding of local critical success factors, and strong commitment to promoting sustainable economic growth and social development in Africa and Asia.

Building and forging global partnerships for infrastructure and sustainable development in Africa

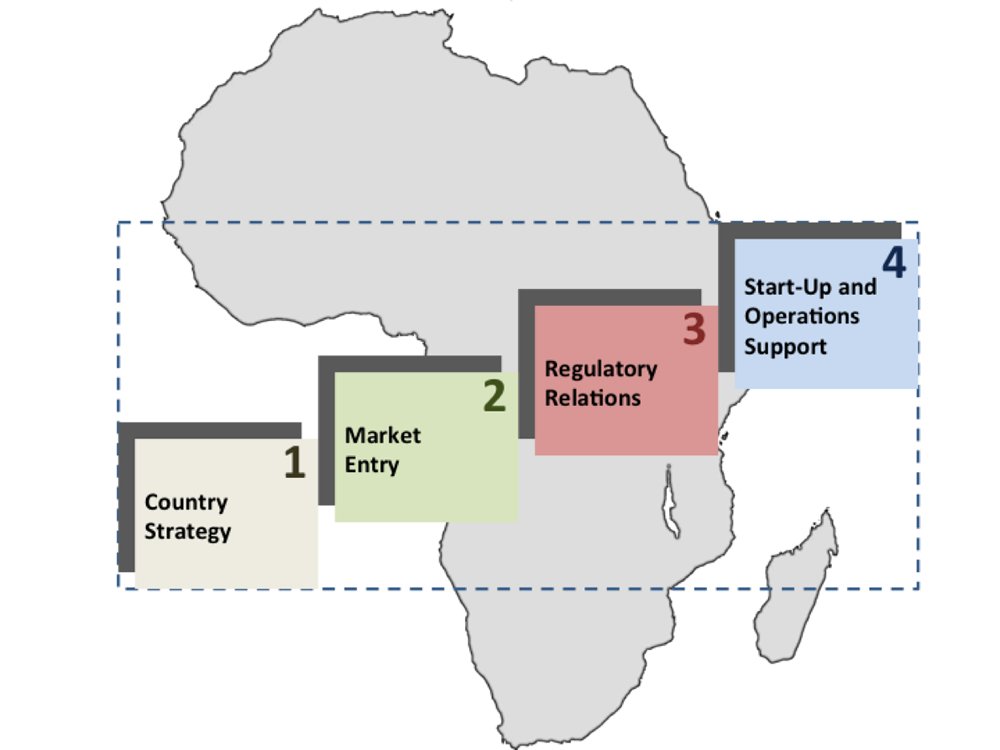

Approach

At the heart of our belief, encouraging Capital not Aid is the critical determinant of long-term success, and global innovation should be harnessed locally with leadership to providing the conditions for that fusion.

Why ASAFBC

Africa can benefit from the rapidly growing markets in China and India (China and India are on track to have 35 percent of the world’s population and 25 percent of its GDP by 2030) to achieve broad-based economic development. To do so, it must determine how to create an enabling environment for engaging more extensively in value added production and participate more effectively in global supply chains.

ASAFBC is positioned to create the largest Asian-African business platform, with a view to significantly boost business and economic growth in Africa. Our world class advisory board and our global operational platform give us the unique capability to help African economies forge innovative partnerships and tap into resources.

Strategy

Proven Approach

Leveraging on our management team’s strong track record of identifying and seizing business opportunities in West Africa, clients take full advantage of our network of government authorities, private and public sector stakeholders.

Growth

Capital Market Solutions

We have developed an extensive network of private sector investment banking and finance partners providing integrated solutions to clients needs, as well as synergistic origination and innovation platforms for strategic capital solutions to African leadership.

Development

Long Term Equity Solutions

Our services range from deal structuring and negotiation, investor, marketing to relevant investors & strategic partners through to final execution in areas such as Joint Venture, Strategic Partnering, Trade-sale, PE, Capital Market Transactions and Strategic Sale.